Tokenization: Transforming Assets into Digital Value

The concept of tokenization is revolutionizing the way we perceive and handle various forms of assets. This article delves into the essence of tokenization, its applications, and the transformative impact it has on the modern economy.

Understanding Tokenization

Tokenization is the process of converting real-world assets into digital tokens on a blockchain. These tokens represent ownership or a stake in the underlying asset. Whether it’s real estate, art, stocks, or other traditional assets, tokenization allows for fractional ownership, enabling broader accessibility and liquidity.

Applications Across Industries

Tokenization has found applications across various industries, offering new opportunities and efficiencies. In real estate, for example, it enables the fractional ownership of properties, making high-value assets accessible to a broader range of investors. Similarly, in the art world, tokenization allows art pieces to be divided into shares, democratizing access to the art market.

Explore the applications and impact of Tokenization on various industries.

Enhanced Liquidity and Accessibility

One of the key benefits of tokenization is the enhanced liquidity it brings to traditionally illiquid assets. By dividing assets into tokens, investors can buy and sell fractions, unlocking liquidity and providing more accessibility to a wider audience. This liquidity can contribute to the efficiency and vibrancy of markets.

Reducing Friction in Transactions

Tokenization streamlines and automates many processes related to the transfer of ownership and value. Traditional transactions involving assets like real estate can be lengthy and cumbersome. Tokenization reduces this friction by enabling seamless and instantaneous transfers, significantly shortening settlement times and reducing administrative overhead.

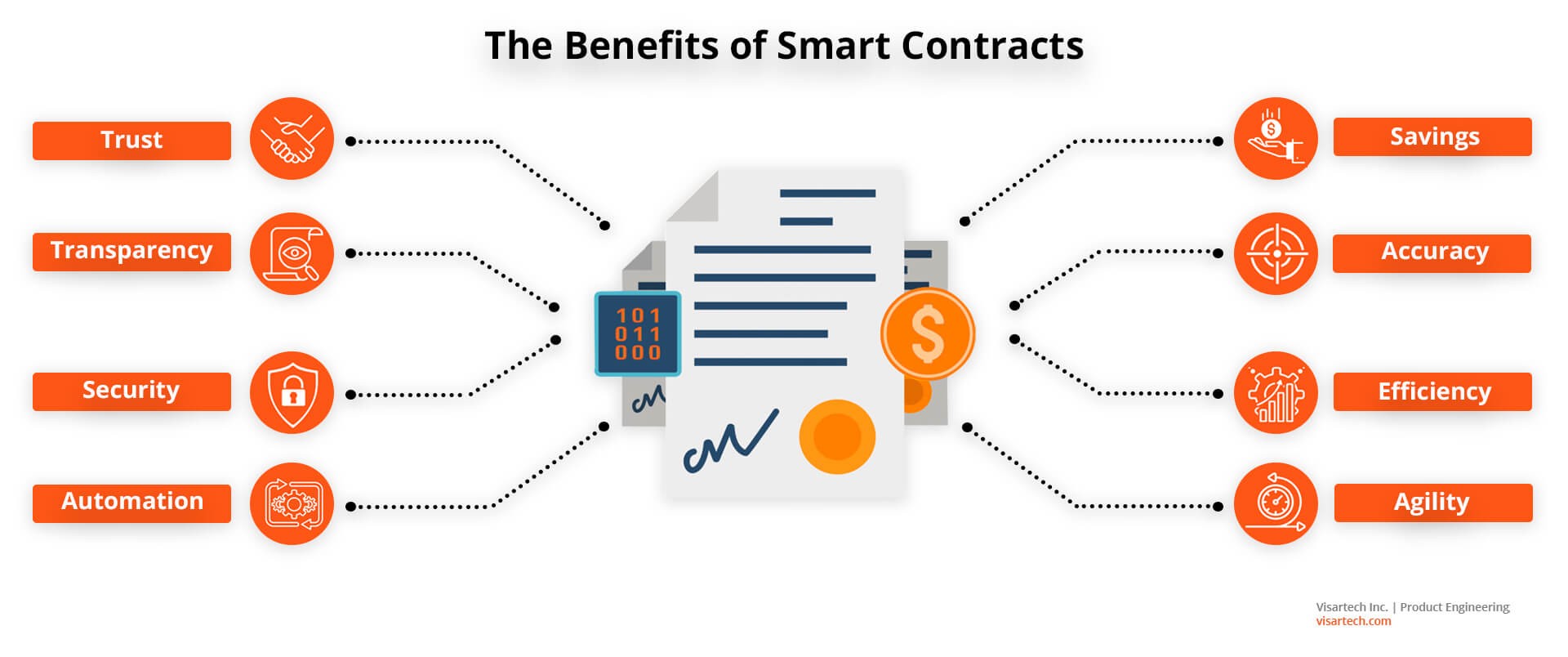

Smart Contracts and Automation

Tokenization often leverages smart contracts, self-executing contracts with the terms directly written into code. Smart contracts automate processes such as dividend distributions, revenue-sharing, or even the enforcement of certain conditions related to the asset. This automation reduces the need for intermediaries and enhances the efficiency of transactions.

Challenges and Regulatory Considerations

While the potential benefits of tokenization are vast, challenges and regulatory considerations exist. Issues such as legal frameworks, standardization, and ensuring compliance with existing regulations need careful attention. As the technology matures, regulatory clarity is expected to play a crucial role in the widespread adoption of tokenization.

Security and Transparency

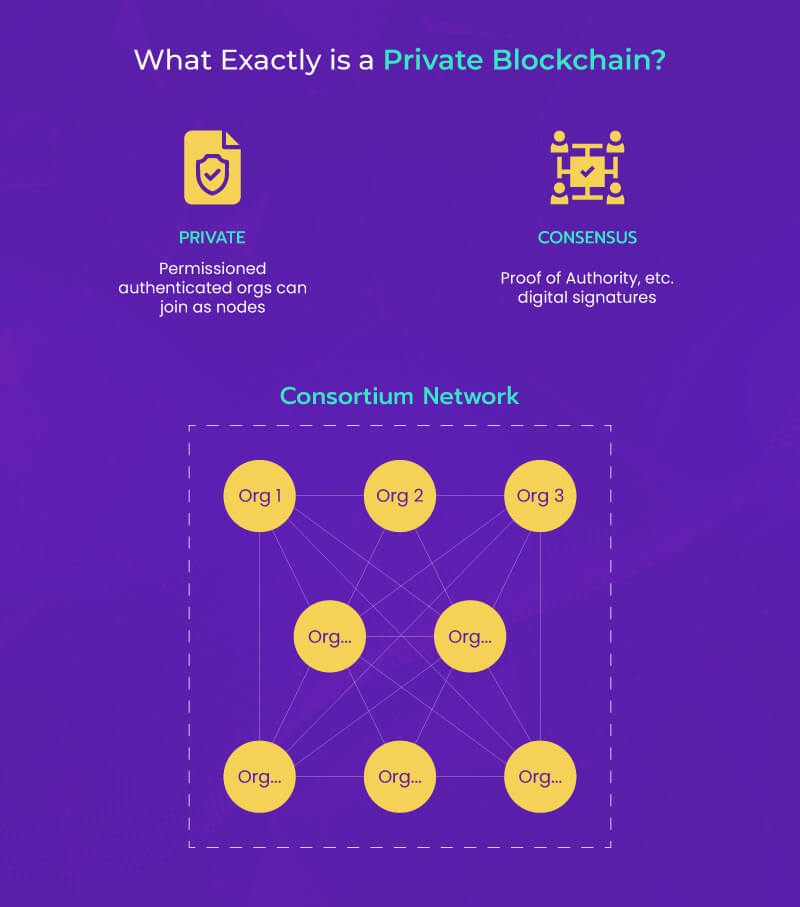

Blockchain, the technology underlying tokenization, is known for its security and transparency. Each transaction and ownership transfer is recorded on the blockchain, creating an immutable and auditable ledger. This transparency builds trust among participants, and the security features of blockchain enhance the overall integrity of tokenized assets.

Tokenization and the Future of Finance

Tokenization has the potential to reshape the financial landscape. It opens up new avenues for fundraising through Security Token Offerings (STOs) and decentralized finance (DeFi) platforms. The ability to represent a wide range of assets digitally can lead to more efficient and inclusive financial systems globally.

Tokenization is a transformative force with implications across industries. Dive deeper into its impact on the future of finance and beyond on itcertswin.com.

Conclusion: A Paradigm Shift in Asset Ownership

Tokenization represents a paradigm shift in how we perceive, trade, and own assets. By digitizing real-world value, tokenization enhances accessibility, liquidity, and efficiency across various industries. As the technology matures and regulatory frameworks evolve, the full potential of tokenization is likely to unfold, offering new possibilities and disrupting traditional notions of asset ownership and value exchange.