Secure Tokenization: Real Assets in the Digital Economy

The intersection of blockchain technology and asset tokenization is reshaping the landscape of traditional finance and investment. This article explores the concept of secure tokenization of real assets, emphasizing its transformative impact on ownership, liquidity, and accessibility in the digital economy.

The Paradigm Shift in Asset Ownership

Traditional ownership of real assets, such as real estate or fine art, often involves complex processes and barriers to entry. Secure tokenization disrupts this paradigm by representing ownership through digital tokens on a blockchain. This shift democratizes access to investments, allowing fractional ownership and lowering the entry threshold for a broader range of investors.

Blockchain’s Role in Security and Transparency

Blockchain’s inherent features, including immutability and transparency, address critical concerns in asset ownership and trading. When real assets are tokenized on the blockchain, each transaction is securely recorded, providing an unalterable history of ownership. This not only enhances security but also fosters trust among investors by offering a transparent view of the asset’s provenance.

Liquidity Unleashed through Tokenization

One of the significant advantages of asset tokenization is the increased liquidity it brings to traditionally illiquid markets. Tokenized assets can be traded on secondary markets 24/7, allowing investors to buy or sell their holdings at any time. This liquidity potential unlocks value, providing investors with flexibility and reducing the holding period associated with traditional investments.

Accessibility for a Diverse Investor Base

Secure tokenization democratizes access to investment opportunities, catering to a more diverse investor base. Through fractional ownership, individuals with limited capital can participate in high-value assets. This inclusivity aligns with the principles of financial democratization, enabling a broader segment of the population to engage in previously exclusive investment markets.

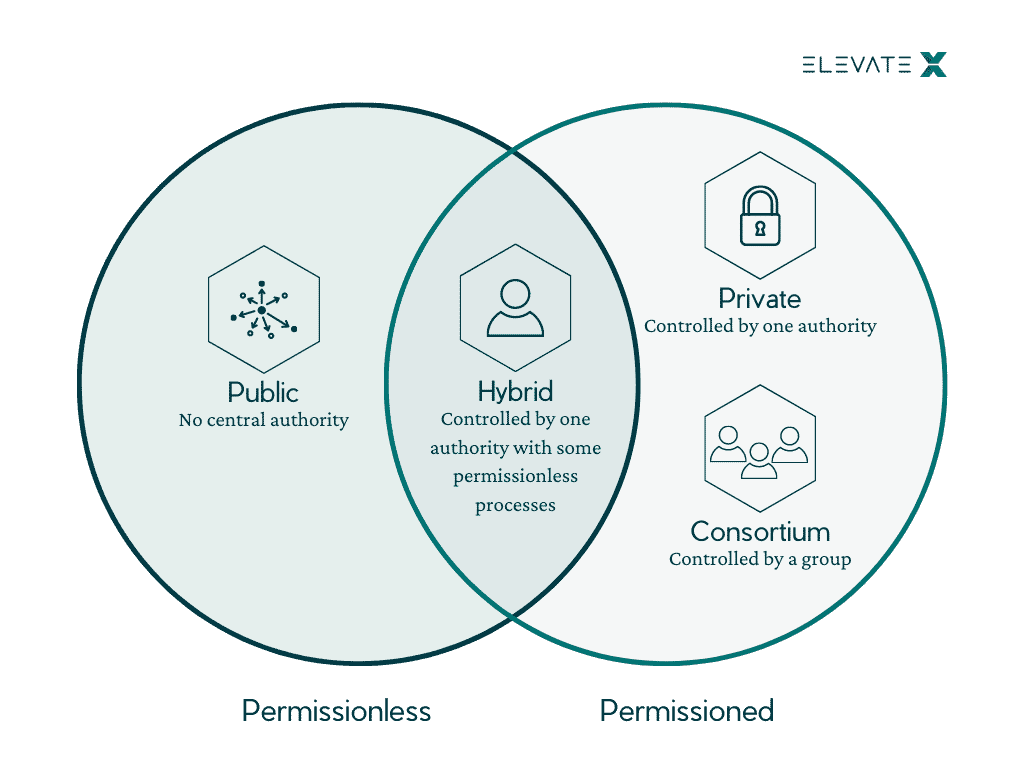

Regulatory Considerations in Tokenized Assets

The regulatory landscape for tokenized assets is evolving, and careful considerations are required to ensure compliance. Various jurisdictions are working on frameworks to govern security token offerings (STOs) and protect investors. Compliance with these regulations not only safeguards investors but also contributes to the legitimacy and acceptance of tokenized assets in traditional financial markets.

Smart Contracts Automating Asset Transactions

Smart contracts play a pivotal role in tokenized asset transactions. These self-executing contracts automatically enforce the terms and conditions coded into the blockchain. For instance, dividend payments, profit distributions, or other contractual agreements are executed without the need for intermediaries, reducing the risk of errors and ensuring transparent and efficient transactions.

Asset Fractionalization and Investment Portfolios

Secure tokenization allows for fractionalization of assets, enabling investors to diversify their portfolios more easily. Fractional ownership in a variety of assets becomes feasible, contributing to risk mitigation and portfolio optimization. This flexibility in constructing investment portfolios aligns with modern investment strategies and risk management principles.

Challenges and Scalability in Tokenization

While the benefits are clear, the tokenization of real assets faces challenges, including scalability concerns and standardization of tokenization protocols. As the adoption of this technology grows, addressing these challenges becomes crucial for realizing the full potential of secure asset tokenization.

Global Adoption and Industry Initiatives

Despite challenges, there is a growing trend toward global adoption of asset tokenization. Various industries, including real estate, art, and venture capital, are witnessing innovative initiatives. These range from tokenizing commercial properties to creating digital securities exchanges, signaling a paradigm shift in how assets are owned, traded, and invested in the digital economy.

Future Trajectory of Asset Tokenization

The secure tokenization of real assets is poised to redefine the future of finance and investment. As technological advancements continue and regulatory frameworks mature, the tokenization of assets is likely to become a mainstream practice. This shift will contribute to a more accessible, transparent, and liquid financial ecosystem in the digital age.

To learn more about the transformative impact of secure tokenization of real assets, visit www.itcertswin.com. Explore the innovations shaping the future of digital finance and investment.