Table of Contents

- Financial Security

- Tangible Asset

- Passive Income

- Appreciation Over Time

- Diversification of Investment Portfolio

- Positive Community Impact

Financial Security

Investing in real estate provides a robust sense of financial security. Unlike stocks that are prone to market volatility, real estate investments tend to offer stability. Many investors appreciate rental properties’ predictable income stream, ensuring a reliable financial base. Institutions like the Minnesota Real Estate School can help you get started, providing essential knowledge and resources. The security in these investments comes from the fact that property prices do not fluctuate wildly overnight. Instead, they provide a more consistent value trajectory. By owning properties in diverse locations, investors can further mitigate risks and enhance financial stability.

Tangible Asset

Unlike stocks or bonds, real estate is a tangible asset you can see and touch, offering a sense of security and control lacking in other investment types. Many investors find comfort in owning a physical property, solidifying its intrinsic value and reliability as an investment. Unlike financial assets vulnerable to market crashes, real estate, such as those recommended by Ham Lake Realtors, tends to retain value even in adverse conditions, making it a resilient option for long-term investment strategies.

Passive Income

One of the alluring aspects of real estate is the potential for passive income. Investors can earn a steady monthly income with minimal day-to-day involvement through rental properties. This passive income can often cover mortgage payments and other expenses, allowing investors to grow wealth without actively working for it. Unlike other investments that require continuous monitoring and adjustment, rental income provides an easier path to financial freedom. The steady stream of rental payments can also cushion during economic downturns, helping investors maintain their lifestyle without liquidating other assets.

Appreciation Over Time

Real estate has a long-standing history of appreciation, making it a popular investment. Properties typically increase in value over time, providing substantial returns. Investors can hold onto properties long-term for financial rewards. Real estate generally appreciates 3-4% annually, varying depending on location and economic conditions. This appreciation and rental income can significantly boost an investor’s portfolio value.

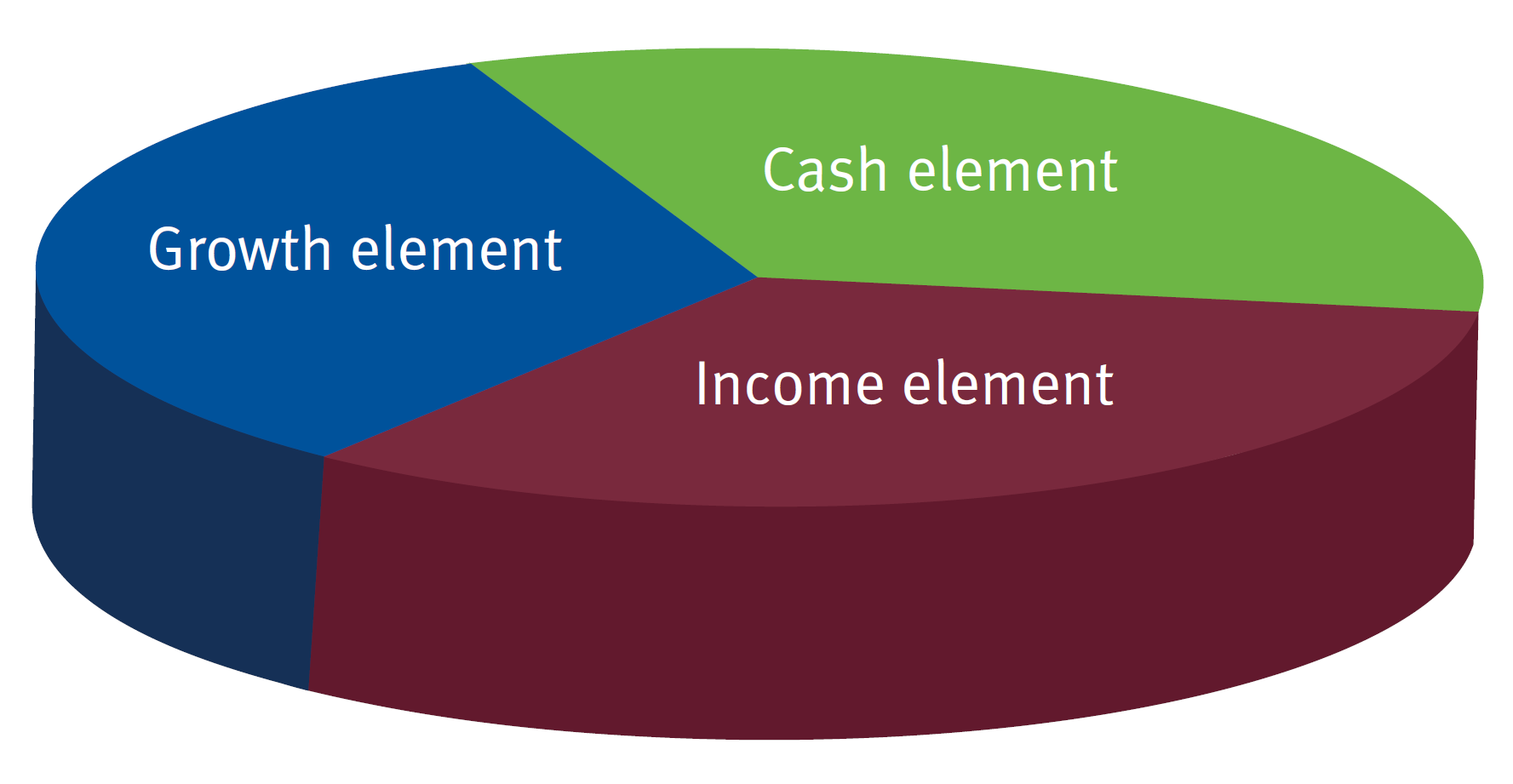

Diversification of Investment Portfolio

One of the most essential methods for lowering risk in an investment portfolio is diversification. By including real estate, investors can mitigate overall portfolio risk. Real estate often hedges against inflation and market downturns, providing a balanced and resilient investment strategy. This diversification ensures that your investment eggs are not all in one basket, spreading risk and increasing the likelihood of better returns across various asset classes.

Positive Community Impact

Investing in real estate can also have positive ramifications for communities. Renovating and maintaining properties contribute to neighborhood stability and aesthetic appeal. Moreover, providing quality rental housing enhances the living conditions for many residents, fostering a vibrant and thriving community. In turn, this boosts local economies and development. Real estate investors often become integral parts of the community fabric, working alongside local governments and organizations to improve everyone’s quality of life.