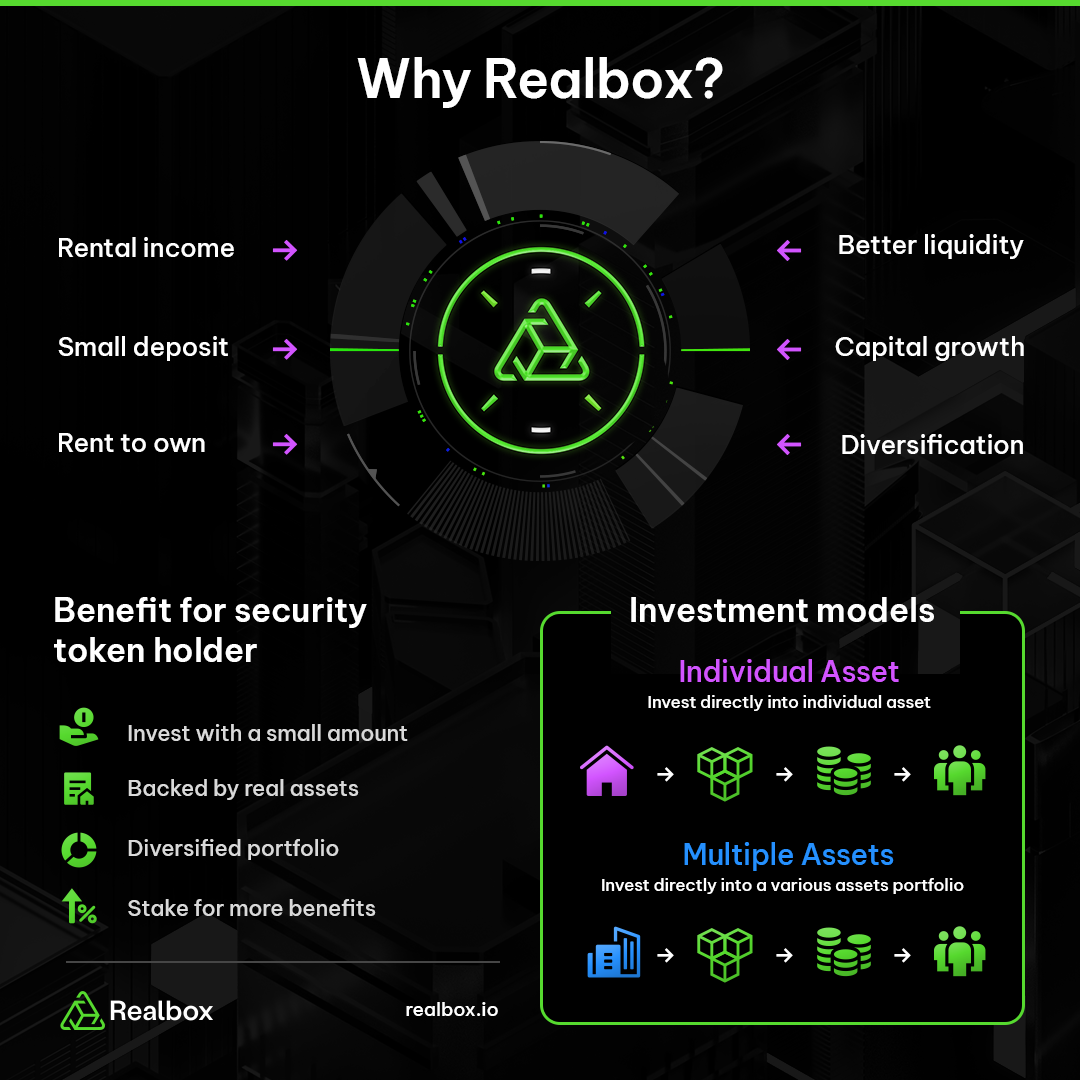

Asset-Backed Security: Tokenized Lending for Trusted Transactions

In the realm of lending, especially asset-backed lending, security and trust form the bedrock of financial transactions. The emergence of secure tokenized asset-backed lending represents a revolutionary approach, reshaping the dynamics of lending against tangible assets. Let’s delve into the key aspects and benefits of this innovative financial paradigm.

Tokenization Redefined: Elevating Security in Asset-Backed Lending

Secure tokenized asset-backed lending introduces a paradigm shift by leveraging tokenization. In this process, tangible assets, such as real estate or commodities, are transformed into digital tokens on the blockchain. This not only enhances security by preventing unauthorized alterations but also establishes an immutable record, ensuring the integrity of asset-backed lending transactions.

Blockchain Security: Safeguarding Asset-Backed Transactions

The robust security features of blockchain play a central role in secure tokenized asset-backed lending. Blockchain’s decentralized and tamper-resistant nature ensures that transaction data remains secure and accessible only to authorized parties. This heightened security minimizes the risks associated with fraud and unauthorized changes to financial terms, providing a secure foundation for asset-backed lending.

Smart Contracts: Precision and Automation in Asset-Backed Lending

Embedded within secure tokenized asset-backed lending are smart contracts, self-executing programs that automate and enforce lending terms. This automation not only streamlines the execution of asset-backed lending transactions but also reduces the need for intermediaries, ensuring that contractual obligations are met efficiently and with precision.

Decentralization: Empowering Financial Transactions Against Assets

The adoption of secure tokenized asset-backed lending marks a move towards decentralized transaction management structures. Traditional asset-backed lending often involves multiple intermediaries and complex processes. The decentralized approach empowers stakeholders by directly recording and governing asset-backed lending terms on the blockchain, fostering transparency and efficiency.

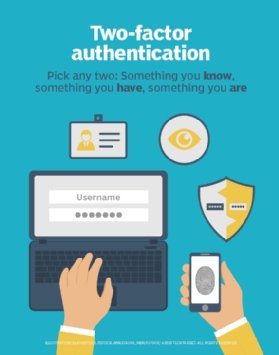

Cryptographic Security: Upholding Confidentiality in Asset-Backed Lending

In secure tokenized asset-backed lending, cryptographic principles play a crucial role in safeguarding sensitive financial information. Each party involved is assigned unique cryptographic keys, establishing a secure channel for communication and data exchange. This cryptographic layer adds an extra dimension of privacy and protection to asset-backed lending transactions.

Tokenization’s Impact: Transforming Asset Representation in Lending

Tokenization not only enhances security but also redefines how tangible assets are represented in asset-backed lending. Digital tokens serve as unique, tamper-proof certificates of financial terms. Secure tokenization facilitates seamless asset-backed lending transactions, providing a clear and indisputable record of financial rights and obligations tied to tangible assets.

Building Trust Through Transparency in Asset-Backed Lending

One of the significant advantages of secure tokenized asset-backed lending is the transparency it brings to financial interactions. All stakeholders can trace the history of an asset-backed lending transaction, ensuring that terms are valid and in compliance. This transparency builds trust among parties involved in asset-backed lending processes.

Efficiency in Asset-Backed Lending Transactions

Secure tokenized asset-backed lending streamlines the lending process, reducing administrative burdens and minimizing the risk of errors. With smart contracts automating tasks such as payment processing and transaction verification, stakeholders can engage in asset-backed lending transactions with confidence, knowing that the process is efficient and secure.

Embracing the Future: Secure Tokenized Asset-Backed Lending

As industries adapt to technological advancements, the adoption of secure tokenized asset-backed lending becomes a strategic move towards the future. These transactions promise enhanced security, transparency, and efficiency in financial interactions tied to tangible assets. To explore the transformative potential of secure tokenized asset-backed lending, visit Secure Tokenized Asset-Backed Lending today.

In conclusion, the emergence of secure tokenized asset-backed lending marks a pivotal moment in the evolution of financial transactions tied to tangible assets. By combining the security of blockchain, the automation of smart contracts, and the transparency of tokenization, these transactions pave the way for a future where asset-backed lending is not only secure but also streamlined and trustworthy.