Revolutionizing Finance: Security in Tokenized Financial Instruments

In the dynamic realm of finance, the digitization of assets and transactions is rapidly gaining traction. Central to this evolution is the concept of secure tokenized financial instruments, offering heightened security and efficiency in an increasingly digital financial landscape.

The Essence of Tokenization in Finance

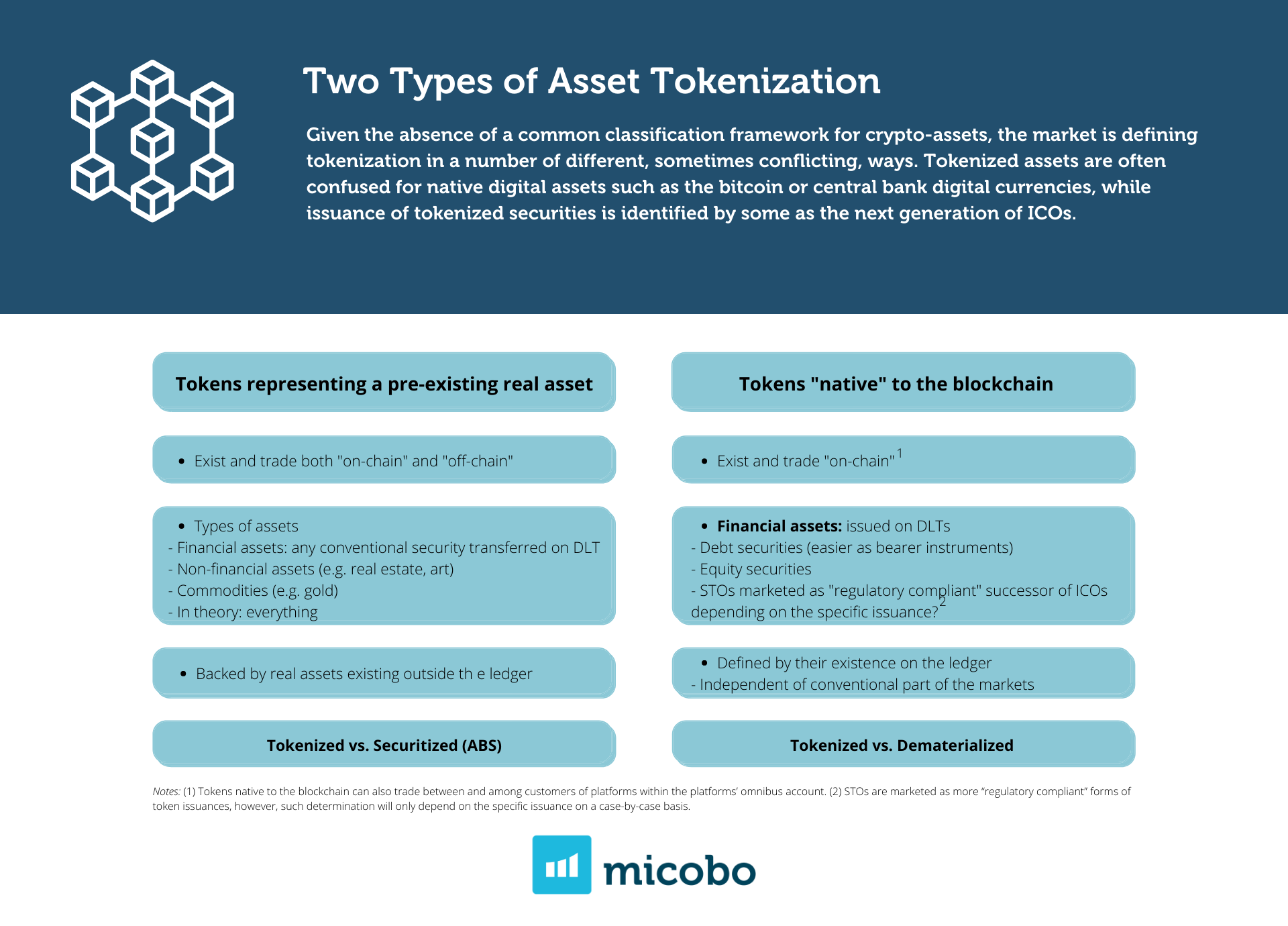

At its core, tokenization involves the conversion of tangible and intangible assets into digital tokens on a blockchain. In the context of financial instruments, this translates into representing assets such as stocks, bonds, or real estate as unique tokens. This process not only facilitates ease of trading but also introduces a robust layer of security.

Enhanced Security Measures in Finance

Security is paramount in the financial sector, and tokenized financial instruments address this concern head-on. Each token represents a specific financial asset and is protected by cryptographic measures, making it highly resistant to fraud and unauthorized access. This ensures the integrity of financial transactions and the safeguarding of investors’ interests.

Efficiency in Trading and Settlement

Tokenized financial instruments streamline the trading and settlement processes. The digitization of assets reduces the need for intermediaries and automates various aspects of transactions, leading to faster and more cost-effective settlements. This efficiency not only benefits investors but also contributes to a more fluid and responsive financial ecosystem.

Blockchain Integration for Immutable Records

The integration of blockchain technology further fortifies the security of tokenized financial instruments. Blockchain’s decentralized and immutable nature ensures that once an asset is tokenized and recorded, it becomes resistant to tampering or fraud. This unalterable record provides a transparent and trustworthy ledger for all financial activities.

Diversification and Accessibility

Tokenized financial instruments open avenues for a broader range of investors to access diverse assets. Fractional ownership becomes feasible, allowing investors to own a portion of high-value assets. This democratization of access to financial instruments can contribute to a more inclusive and accessible financial landscape.

Addressing Regulatory and Compliance Challenges

The adoption of tokenized financial instruments brings forth regulatory and compliance challenges. Standardizing practices and ensuring adherence to regulatory frameworks are crucial steps in overcoming these challenges. Collaborative efforts between financial institutions, regulators, and technology providers play a pivotal role in shaping the regulatory landscape for tokenized assets.

Innovations in Financial Technology

As technology continues to advance, the intersection of financial technology (fintech) and tokenized instruments leads to continuous innovation. Smart contracts, artificial intelligence, and decentralized finance (DeFi) are poised to enhance the capabilities and functionalities of tokenized financial instruments, paving the way for a new era in finance.

Empowering Investors and Institutions

The benefits of secure tokenized financial instruments extend to both individual investors and institutional entities. Individual investors gain access to a more diverse portfolio, while institutions benefit from increased liquidity and efficiency in asset management. This mutual empowerment reshapes the dynamics of the financial market.

Building Trust in Digital Finance

In conclusion, the adoption of secure tokenized financial instruments marks a transformative shift in the financial landscape. As technology advances and regulatory frameworks evolve, the integration of tokenized assets becomes pivotal in building trust, enhancing security, and fostering a more inclusive and efficient financial ecosystem.

To explore the potential of secure tokenized financial instruments, visit www.itcertswin.com. Elevate your financial transactions with the latest innovations in digital finance.