Navigating Dynamic Tokens: Understanding Freezing and Thawing Mechanisms

Token freezing and thawing mechanisms have become pivotal in the world of blockchain and cryptocurrencies, introducing dynamic features that add an extra layer of control and security to token management.

Introduction to Token Freezing and Thawing

In the realm of blockchain, token freezing and thawing refer to the ability to temporarily immobilize or unfreeze a certain amount of tokens. This dynamic functionality allows project developers and token holders to exercise a degree of control over the circulation and utility of tokens within a decentralized ecosystem.

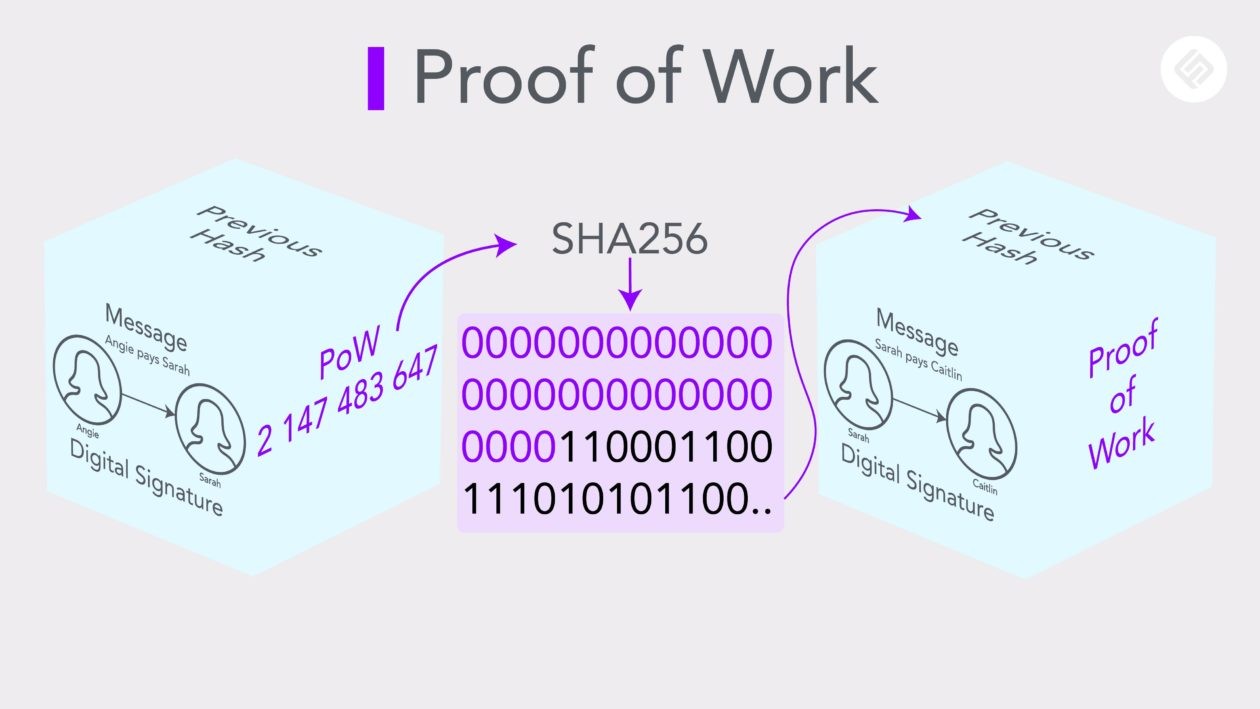

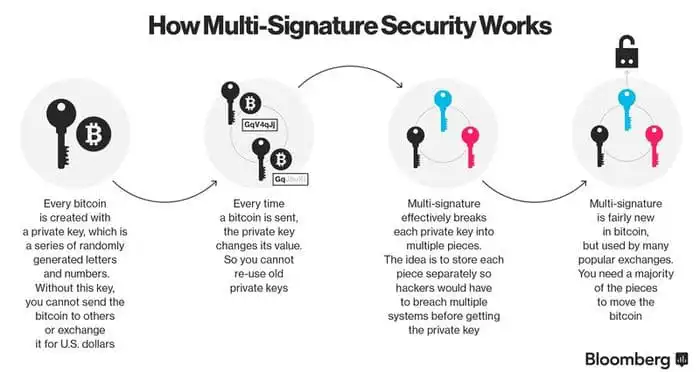

Enhancing Security through Freezing Mechanisms

One of the primary reasons for implementing token freezing mechanisms is to enhance security. In cases of security breaches, suspicious activities, or unforeseen circumstances, freezing tokens can act as a safeguard. By temporarily halting the movement of tokens, potential damage or unauthorized transactions can be mitigated, protecting the integrity of the blockchain project.

Mitigating Risks and Ensuring Stability

Token freezing serves as a risk mitigation strategy. In times of market volatility or when a project undergoes significant changes, temporarily freezing tokens can help maintain stability. This feature enables project teams to assess and address potential challenges without the added pressure of continuous token circulation.

Empowering Project Developers with Control

For project developers, token freezing provides an essential tool for maintaining control over the project’s economic aspects. It allows developers to respond to evolving circumstances, address vulnerabilities, and implement strategic changes without compromising the overall stability of the token ecosystem.

The Dynamic Nature of Token Thawing

Token thawing, on the other hand, introduces a dynamic element to the token ecosystem. Once tokens are frozen, thawing mechanisms allow for their release back into circulation after a specified period or under certain conditions. This feature adds flexibility and adaptability to the token’s lifecycle.

Facilitating Liquidity and Utility

Thawing mechanisms play a crucial role in facilitating liquidity and utility within the token ecosystem. By allowing frozen tokens to thaw, projects can ensure a continuous flow of tokens for trading, transactions, and other use cases. This dynamic approach contributes to the overall liquidity and functionality of the token.

Striking a Balance: The Art of Token Dynamics

Implementing token freezing and thawing mechanisms requires striking a delicate balance. While freezing enhances security and risk mitigation, thawing ensures that tokens remain liquid and usable. The art lies in finding the right equilibrium that aligns with the project’s goals, user needs, and the evolving dynamics of the cryptocurrency market.

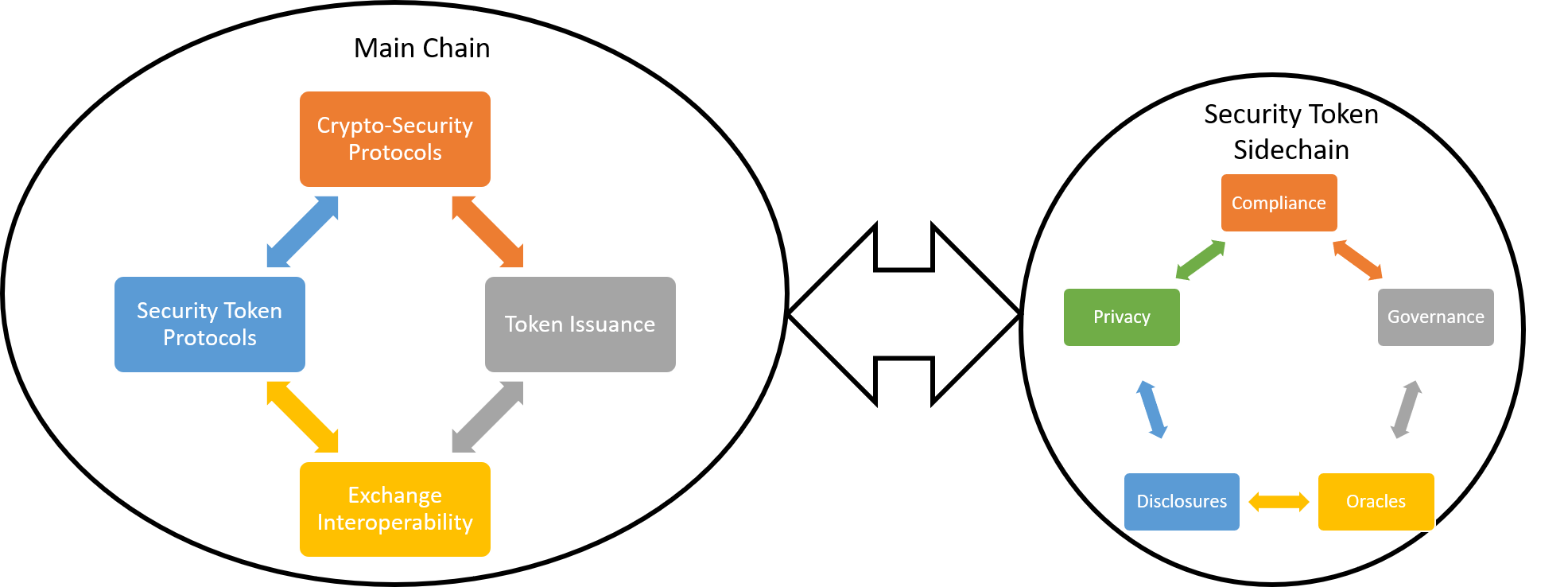

Transparent Governance and Communication

Projects that incorporate token freezing and thawing mechanisms should prioritize transparent governance and communication. Clearly defining the conditions under which tokens can be frozen or thawed, and keeping the community informed about these processes, fosters trust and understanding. Transparent governance is key to maintaining a healthy and engaged user base.

Navigating Token Freezing and Thawing Mechanisms

For blockchain projects looking to explore the possibilities of token freezing and thawing mechanisms, platforms like Token Freezing and Thawing Mechanisms offer valuable insights and solutions. These platforms provide the necessary tools and resources for implementing dynamic token features, empowering projects to navigate the complexities of token management.

Embracing the Future of Tokenomics

In conclusion, the integration of token freezing and thawing mechanisms marks a significant step in the evolution of tokenomics. These dynamic features enhance security, mitigate risks, and provide project developers with a powerful tool for maintaining control. As blockchain technology continues to evolve, the adoption of such innovative token management strategies will likely shape the future of decentralized ecosystems.