The Growing Trend of Token Swaps

In the dynamic realm of blockchain and cryptocurrency, token swaps have become an integral part of decentralized finance (DeFi) ecosystems. As this trend gains momentum, ensuring the security of these transactions is paramount for users seeking to participate in the token exchange landscape.

Understanding the Risks

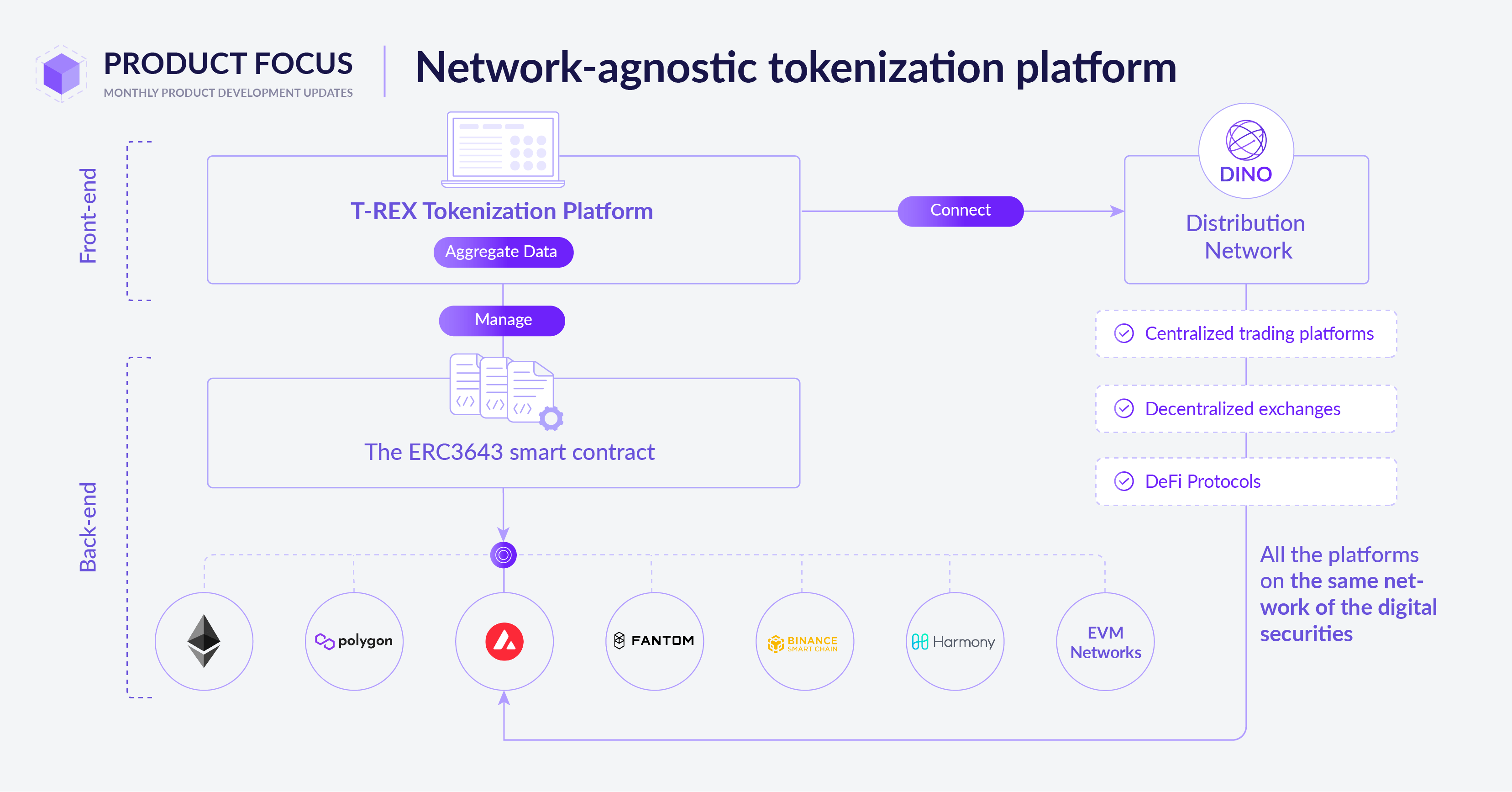

Token swaps involve the exchange of one cryptocurrency for another without the need for a centralized intermediary. While this decentralized approach offers numerous benefits, it also comes with inherent risks. Smart contract vulnerabilities, liquidity issues, and potential exploits pose challenges that must be addressed to create a secure token swapping environment.

Smart Contract Security

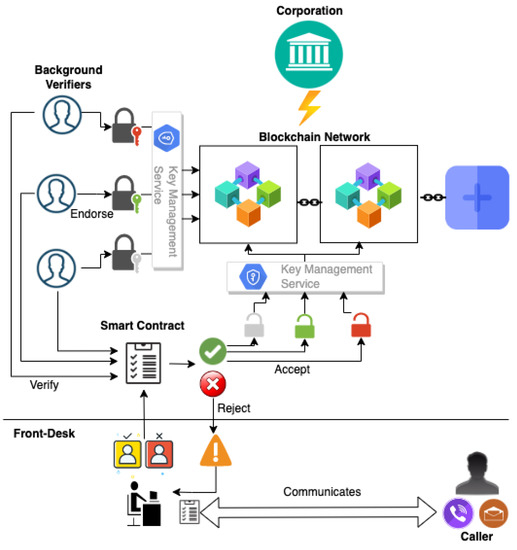

Smart contracts are the backbone of token swaps, governing the rules and conditions of the exchange. Securing these contracts is crucial to prevent vulnerabilities that could be exploited by malicious actors. Regular audits by reputable firms, code reviews, and rigorous testing are essential steps to ensure the integrity and security of the smart contracts involved in token swaps.

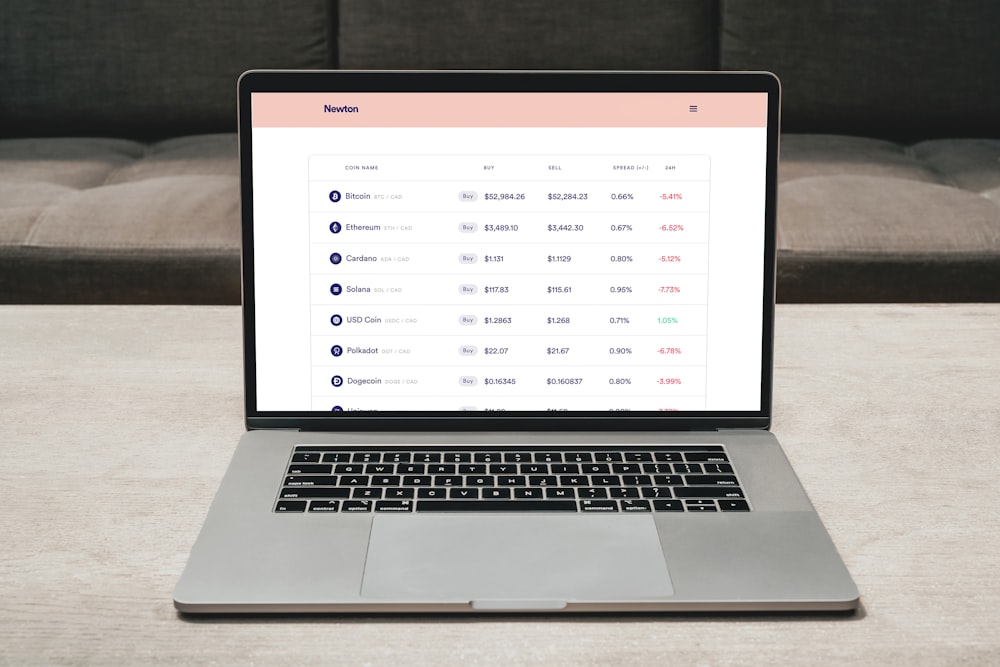

Liquidity and Price Impact

A secure token swapping mechanism must address liquidity concerns to prevent slippage and price manipulation. Adequate liquidity ensures that users can execute their trades without significant price impact. Platforms facilitating token swaps should implement strategies such as liquidity pools and dynamic pricing algorithms to maintain a stable and secure trading environment.

Decentralized Governance

Decentralized governance plays a pivotal role in shaping the policies and parameters of token swapping platforms. Community-driven decision-making enhances transparency and inclusivity. Platforms that prioritize decentralized governance empower users to actively participate in the evolution of the ecosystem, fostering a sense of ownership and security.

Multi-Signature Wallets for User Protection

To enhance user protection, platforms facilitating token swaps should integrate multi-signature wallets. Multi-signature wallets require multiple private keys to authorize transactions, reducing the risk of unauthorized access and ensuring that users maintain control over their assets during the token exchange process.

Real-Time Monitoring and Security Measures

Continuous monitoring of the token swapping platform is crucial for identifying and mitigating security threats promptly. Implementing real-time monitoring tools and security measures helps in detecting anomalies, potential attacks, or irregularities in the system. Proactive security measures contribute to a safer and more reliable token swapping experience for users.

User Education and Awareness

Empowering users with knowledge about secure practices is a fundamental aspect of enhancing the security of token swaps. Educational resources, tutorials, and clear guidelines can help users make informed decisions and navigate the complexities of decentralized exchanges with confidence.

Regulatory Compliance

Ensuring compliance with relevant regulations is vital for the long-term sustainability and acceptance of token swapping platforms. Platforms should actively collaborate with regulatory authorities and adhere to legal frameworks to provide users with a secure and compliant trading environment.

Secure Token Swaps: A Call to Action

In conclusion, the rising popularity of token swaps necessitates a concerted effort to prioritize security measures. By addressing smart contract security, liquidity concerns, decentralized governance, user protection, real-time monitoring, and regulatory compliance, the cryptocurrency community can collectively contribute to creating a secure and trustworthy token swapping ecosystem.

Explore the world of Secure token swaps and embrace the future of decentralized finance with confidence. Secure your assets and actively participate in the evolving landscape of blockchain-based token exchanges.