Navigating KYC Regulations: Building Trust in Financial Interactions

Know Your Customer (KYC) regulations serve as a cornerstone in establishing trust within financial interactions. This article delves into the significance of KYC regulations, their impact on building trust, and the evolving landscape of identity verification in the financial sector.

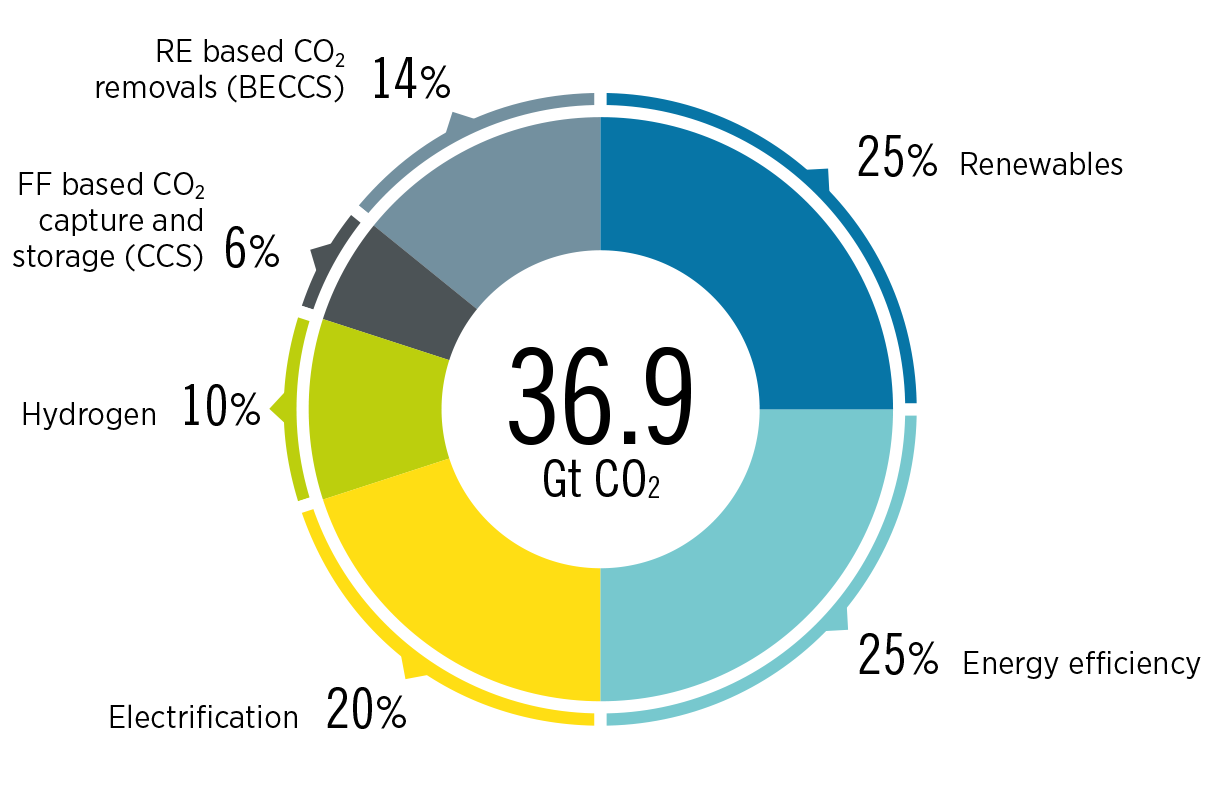

Understanding KYC Regulations

KYC regulations mandate financial institutions to verify the identity of their customers, ensuring they have a comprehensive understanding of who they are dealing with. The primary goal is to prevent fraudulent activities, money laundering, and terrorist financing. KYC processes involve gathering information about customers’ identity, address, and financial transactions.

The Importance of Building Trust

Building trust is fundamental in the financial sector. KYC regulations play a crucial role in this process by providing a transparent framework for identity verification. When customers know that their information is being diligently verified, it instills confidence in the financial system, fostering a trustworthy relationship between customers and institutions.

Enhancing Security Through KYC

KYC regulations are a proactive measure to enhance the security of financial transactions. By verifying the identities of customers, financial institutions can mitigate the risk of unauthorized transactions and identity theft. The implementation of KYC measures contributes to the overall integrity and security of the financial ecosystem.

Streamlining Onboarding Processes

While KYC regulations are essential for security, they also impact the customer onboarding process. The challenge lies in striking a balance between thorough identity verification and providing a seamless customer experience. Technological innovations, such as digital identity verification tools, aim to streamline onboarding processes while ensuring compliance with KYC regulations.

Technological Innovations in KYC

The landscape of KYC is evolving with advancements in technology. Automated identity verification processes, biometric authentication, and blockchain-based solutions are revolutionizing how KYC is conducted. These innovations not only improve the efficiency of KYC procedures but also enhance the accuracy and reliability of identity verification.

Global Standardization in KYC

In a world where financial transactions span across borders, achieving global standardization in KYC becomes crucial. International efforts are underway to harmonize KYC regulations, making it easier for financial institutions to comply with consistent standards regardless of the geographic location of their customers.

Challenges in KYC Compliance

Despite the benefits, KYC compliance poses challenges for financial institutions. The resource-intensive nature of manual KYC processes, coupled with the need for ongoing monitoring, can strain operational efficiency. Addressing these challenges requires a combination of technological solutions and regulatory cooperation.

KYC as a Deterrent Against Financial Crimes

KYC regulations act as a deterrent against financial crimes. The stringent identity verification processes make it more difficult for criminals to use the financial system for illicit activities. By incorporating KYC measures, the financial industry contributes to broader efforts in combatting money laundering and fraud.

Adapting to Evolving Regulatory Landscape

The regulatory landscape surrounding KYC is continually evolving. Financial institutions must remain agile and adapt to changes in regulations. Staying informed about the latest developments and investing in technologies that facilitate compliance is essential for navigating the dynamic KYC landscape.

Explore KYC Regulations at www.itcertswin.com

For in-depth insights into Know Your Customer (KYC) regulations and how they shape the financial industry, visit www.itcertswin.com. Explore resources, stay updated on regulatory changes, and gain a deeper understanding of the evolving landscape of identity verification in financial transactions.

In conclusion, navigating KYC regulations is integral to building trust in financial interactions. As technology continues to advance, the implementation of innovative KYC solutions becomes paramount in achieving a delicate balance between security and a seamless customer experience.