ICO Revolution: Transforming Funding in the Digital Era

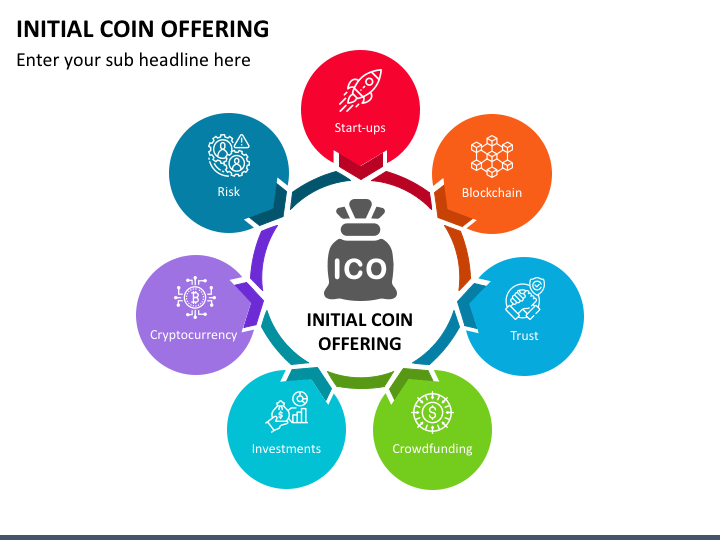

The phenomenon of Initial Coin Offerings (ICOs) has reshaped the landscape of fundraising, offering a decentralized and efficient way for projects to secure capital. This article explores the evolution of ICOs, their impact on the digital economy, and the considerations for both investors and project founders.

Understanding ICOs

ICO refers to a fundraising method where a new cryptocurrency project sells its tokens to early investors. These tokens, often created on existing blockchain platforms like Ethereum, represent a stake in the project and may have utility within the project’s ecosystem. ICOs emerged as an alternative to traditional fundraising methods, providing access to a global pool of investors.

Decentralized Funding Model

ICOs operate on a decentralized model, allowing project founders to raise funds directly from the community without the need for intermediaries like banks or venture capitalists. This decentralization democratizes access to investment opportunities, enabling a more inclusive approach to fundraising.

Explore the evolution and impact of Initial Coin Offerings (ICOs) in the digital economy.

Tokenization of Projects

One of the key aspects of ICOs is the tokenization of projects. Instead of traditional equity, investors receive tokens that may have various functions within the project’s ecosystem. These tokens can represent ownership, access to services, or even governance rights within the decentralized network.

Global Accessibility

ICOs break down geographical barriers, allowing projects to attract a global pool of investors. This global accessibility opens up opportunities for both project founders and investors to participate in projects from different parts of the world. It also fosters a diverse and inclusive investment landscape.

Potential for High Returns

Investors are drawn to ICOs due to the potential for high returns. Early participation in a successful project can lead to substantial gains as the value of the project’s tokens appreciates. However, it’s crucial for investors to conduct thorough research and due diligence as the high returns come with inherent risks.

Challenges and Risks

While ICOs offer innovative fundraising opportunities, they are not without challenges and risks. The decentralized and relatively unregulated nature of ICOs has led to instances of fraud and scams. Investors must exercise caution, conduct thorough research, and be aware of the risks associated with investing in emerging projects.

Regulatory Landscape

The regulatory environment surrounding ICOs has evolved over time. Various jurisdictions have implemented or are in the process of developing regulations to address the challenges associated with ICOs, such as investor protection and fraud prevention. Navigating the regulatory landscape is a crucial consideration for both project founders and investors.

Initial Coin Offerings (ICOs) have left a lasting impact on fundraising and investments. Discover more insights on itcertswin.com.

Conclusion: Shaping the Future of Fundraising

ICOs have played a pivotal role in shaping the future of fundraising in the digital era. By leveraging blockchain technology and decentralized networks, ICOs offer a new paradigm for accessing capital and participating in innovative projects. As the landscape continues to evolve, the lessons learned from the ICO revolution will likely influence the development of future fundraising models in the ever-changing digital economy.